oklahoma inheritance tax rate

The role of gift taxes in oklahoma. The current amount that requires federal taxes is any inheritance equal to or greater than 5490000.

Oklahoma Estate Tax Everything You Need To Know Smartasset

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

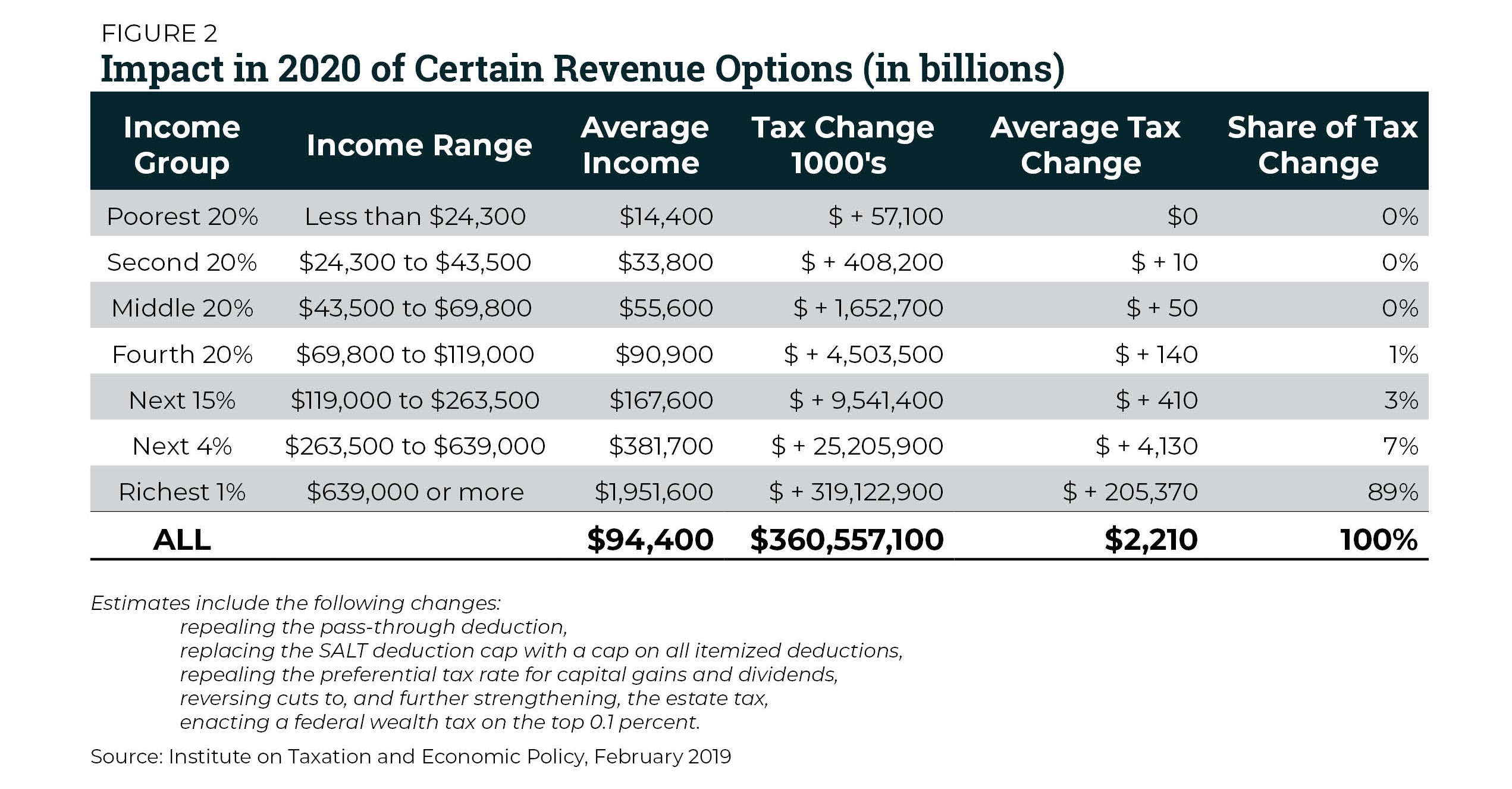

. Although the government grants money to the states additional revenues. State inheritance tax rates in 2021 2022. With local rates included the total sales tax averages a very high.

The top estate tax rate is 16 percent exemption threshold. Ad Inheritance and Estate Planning Guidance With Simple Pricing. The income tax in Oklahoma is progressive with rates ranging from 050 to 500.

Ad Estate Trust Tax Services. The top estate tax rate is 16 percent exemption threshold. Those that report 41676 up to 459750 are in the 15 percent capital gains bracket.

No More Oklahoma Estate Tax at least beginning in 2010 T he Oklahoma estate tax system has been permanently repealed for deaths occurring on or after January 1 2010. State inheritance tax rates range from 1 up to 16. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

Gift taxes are related to estate taxes but slightly different. The statewide sales tax in Oklahoma is 450. On large estates that are subject to the federal estate tax the giftestate tax rate is currently 40 which is an increase over the 35 that was in.

Before the official 2022 Oklahoma income tax rates are released provisional 2022 tax rates are based on Oklahomas 2021 income tax brackets. The highest income earners pay a 20 percent capital gains rate. If you claim 41675 or less as an individual taxpayer you are exempt.

These are the rates that are in place. The federal estate tax exemption for 2018 is 56 million per person. No estate tax or inheritance tax.

Call for Your Free Consultation 4057884662. The tax rate on estates larger than the exempt amounts was increased from 35 in 2012 to 40 in 2013 and beyond. The Role of Gift Taxes in Oklahoma.

Income tax 05 - 5. Oklahoma Estate and Inheritance Taxes. What is the estate tax in Oklahoma.

Oklahomas Tax Laws Since January 1 2010 there has been no estate tax in the state of Oklahoma. The federal annual gift exclusion is now 15000. The top inheritance tax rate is 15 percent no exemption threshold rhode island.

As a result if a persons estate is less than 5490000 and there are no other involved states an inheritance will likely not be taxed. Spouses are also completely exempt from the inheritance tax regardless of the amount. The state with the highest maximum estate tax rate is washington 20 percent followed by eleven states which have a maximum rate of 16 percent.

Note that historical rates and tax laws may differ. To learn more about inheritance. There is no inheritance tax Oklahoma.

A strong estate plan starts with life insurance. Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. The long-term capital gains rate that applies to you will depend on your income level.

Richards Attorney at Law today. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. In addition to the repeal of the estate tax the Oklahoma inheritance tax has an exemption amount of 5000000.

Note that historical rates and tax laws may differ. States have the right to impose their own taxes on residents and non-residents with nexus to the state tax Oklahoma charges on top of the nationwide federal tax. To learn more about inheritance and estate taxes in Oklahoma City contact Elizabeth A.

Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. And remember we do not have an Oklahoma estate tax. Although there is no inheritance tax in oklahoma you must consider whether your estate is large enough to require the filing of a federal estate tax return form 706.

The 2022 state personal income tax brackets are updated from the Oklahoma and Tax Foundation data. Learn How EY Can Help. Oklahoma tax forms are sourced from the Oklahoma income tax forms page and are updated on a yearly basis.

In Oklahoma the median property tax rate is 892 per 100000 of assessed home value. No estate tax or inheritance tax.

Historical Oklahoma Tax Policy Information Ballotpedia

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Oklahoma Estate Planning Will Drafting And Estate Administration Forms Lexisnexis Store

Dekalb County Ga Property Tax Calculator Smartasset

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Oklahoma Estate Planning Will Drafting And Estate Administration Forms Lexisnexis Store

Oklahoma Estate Tax Everything You Need To Know Smartasset

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Oklahoma Estate Tax Everything You Need To Know Smartasset

Estate Planning What Is The Tax Cliff Nfib

Treasurer Butch Forrest Freeman